Zin Gas Field Feasibility Report: Commercial Viability and Upside Potential

Table of Contents

-

- Executive Summary

-

- Overview of Zin Gas Field

- Key Findings on Commercial Viability

- Immediate Production and Sales Potential

-

- Long-Term Upside Potential

- Overview of Zin Gas Field

-

- Acknowledgment

-

- Introduction

-

- Purpose of the Report

- Scope of the Feasibility Study

-

- Methodology

- Purpose of the Report

-

- Field Overview

-

- Location and Ownership

- History and Development Timeline

-

- Current Status of Wells and Infrastructure

- Location and Ownership

-

- Security Status and Key Risks

-

- Regional Security Overview

- Operational Risk Factors

- Environmental and Regulatory Risks

-

- Market and Pricing Volatility

- Regional Security Overview

-

- Reserves and Production Potential

-

- 2P Reserves Estimation

- Anticipated Initial Production Rates

-

- Projected Field Life and Production Profile

- 2P Reserves Estimation

-

- Gas Composition and Quality

-

- Detailed Gas Composition Analysis

- Heating Value and Specific Gravity

-

- Environmental and Safety Considerations (H2S Content)

- Detailed Gas Composition Analysis

-

- Infrastructure and Logistics

-

- Proximity to Pirkoh Valve Assembly and LOTI

- Pipeline Distance and Elevation Profile

-

- Existing and Required Facilities

- Proximity to Pirkoh Valve Assembly and LOTI

-

- Commercial Viability Analysis and Hindrances in Implementation

-

- Short-Term Gas Production and Sales Strategy

- Pricing and Revenue Projections

- Break-even Analysis and Profitability

- Short-Term Commercial Viability

- Immediate Gas Production and Sales Strategy

- Transportation Logistics to Pirkoh Valve Assembly and Loti fields

- Technical Challenges and Workover Plans

- Long-Term Commercial Viability

- Production Forecast and Decline Management

- Upside Potential and Field Life Extension Strategies

-

- Hindrances in Implementation

- Short-Term Technical and Operational Challenges

-

- Long-Term Market Risks and Regulatory Compliance

- Hindrances in Implementation

- Short-Term Gas Production and Sales Strategy

-

- Forward Plan

-

- Reactivation of Suspended Wells and Production Integration

- Infrastructure Development and Pipeline Construction

-

- Regular Forecast Updates and Production Optimization

- Reactivation of Suspended Wells and Production Integration

-

- Investment Strategy for Upside Potential

-

- Long-Term Development Plan

- Capital Expenditure for Additional Wells

-

- Enhanced Recovery Techniques and Technologies

- Long-Term Development Plan

-

- Risk Assessment and Mitigation

-

- Technical and Operational Risks

- Market and Pricing Risks

-

- Regulatory and Environmental Risks

- Technical and Operational Risks

-

- Financial Projections and Cash Flow Analysis

-

- Detailed Cash Flow Projections

- Sensitivity Analysis

-

- Return on Investment and Payback Period

- Detailed Cash Flow Projections

-

- Conclusion and Recommendations

-

- Summary of Commercial Viability

- Strategic Recommendations for Immediate and Future Development

-

- Next Steps for Implementation

- Summary of Commercial Viability

-

- Appendices

-

- Supporting Data and Graphs

- Assumptions and Limitations of the Study

-

- References and Sources

- Supporting Data and Graphs

Executive Summary – May 2024

The Zin Gas Field, a strategic hydrocarbon asset in district Dera Bugti, Baluchistan, was initially discovered by Pakistan Petroleum Limited (PPL) in 1956 within the Sui Main Limestone reservoir. However, PPL later relinquished this discovery due to a higher percentage of inert and lack of marketability, while PPL had already discovered a giant gas field of Sui with a BTU value of 1000 plus. The area was subsequently picked up by OGDCL, which led to the discovery of a new hydrocarbon-bearing Pab Sandstone reservoir in its exploratory well Zin X-1 in 2012. OGDCL, with a 95% working interest, alongside GHPL with 5%, has since been at the forefront of appraising and developing the field. Our Online Trusted Website gives to Zin Like Gas Field Feasibility Report in 1 Click.

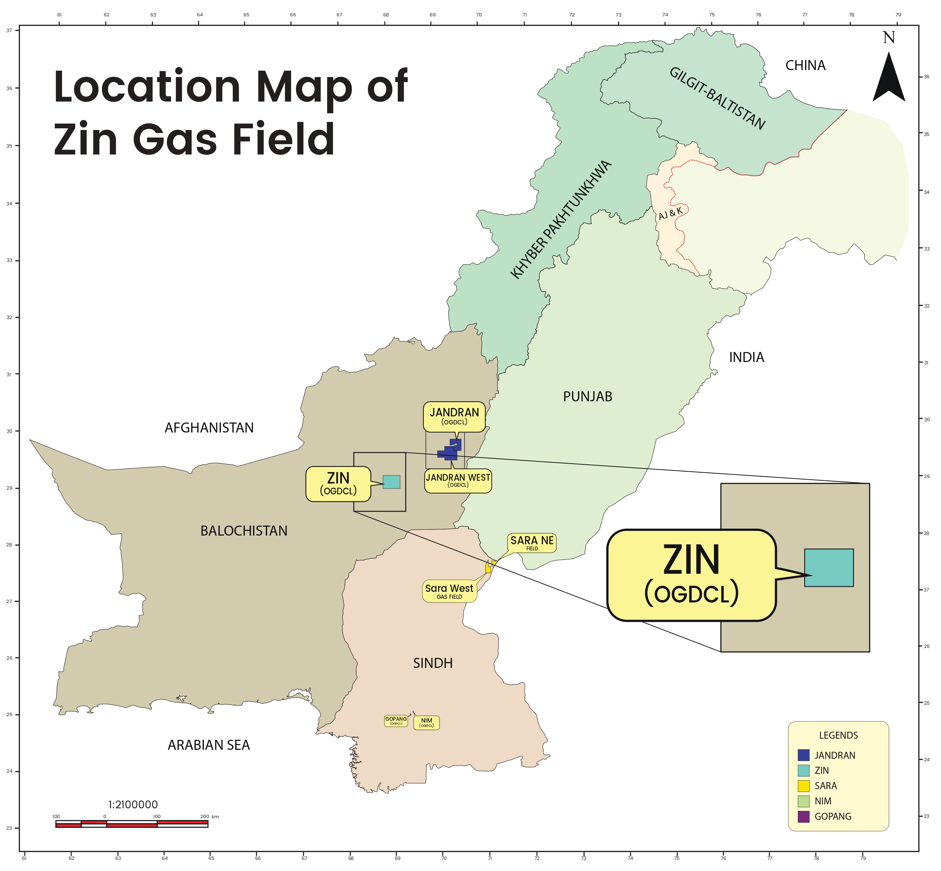

Figure 1: Location Map of Zin Gas Field in Pakistan

The Zin Gas Field’s 2P reserves are estimated at 840 BCF, distributed across the PAB and SML formations. With nine wells already drilled, the field currently has a production potential of 36 MMSCFD. The discovery well, Zin X-1, initially tested at a flow rate of 5.48 MMCFD from the Pab Sandstone reservoir, with a wellhead flowing pressure of 1050 psi. The gas extracted from this reservoir is characterized by a low heating value of approximately 400 BTU/MMCFD, indicating its suitability primarily for power generation purposes.

The Zin Like Gas Field Feasibility has evaluated various development cases, including the sale of raw gas at the field gate with and without compression (Cases 1A and 1B), diversion of raw gas for processing at the Uch Facility (Case 2), sale of Medium Calorific Value (MCV) gas (Case 3), and sale of dehydrated gas (Case 4). These cases have been assessed for scenarios involving the existing nine wells and a future scenario with an additional 15 wells. The study highlights the need for dedicated gathering lines due to the different wellhead flowing pressures of the PAB and SML formations, as well as the implementation of compression and processing facilities to meet various sales gas specifications.

The composition of gases from the Zin Gas Field reveals Methane (C1) as the major component, with concentrations of 36.37% in PAB and 49.03% in SML. Carbon Dioxide (CO2) is another significant component, with 47.32% in PAB and 37.71% in SML. Nitrogen (N2) is present at 15.1% in PAB and 12.39% in SML. Hydrogen Sulfide (H2S) is not detectable in the SML sample as shown in the given tables. The Lower Heating Value (LHV) is 353.7 BTU/SCF for PAB, 467.9 BTU/SCF for SML, and 403.8 BTU/SCF when commingled. The Higher Heating Value (HHV) is 389.4 BTU/SCF for PAB, 515.2 BTU/SCF for SML, and 444.6 BTU/SCF for the commingled gas. The Operating Dew Point is -2.7°F for PAB and 38.2°F for SML, with the commingled sample at 17.25°F. The Hydrate Formation Temperature is consistent across the samples, at 52.2°F, 51.5°F, and 52°F respectively as shown in the given tables.

In conclusion, the Zin Gas Field holds considerable promise for commercial viability and represents a strategic opportunity for OGDCL and its partners. The field’s rich history, coupled with a strategic development plan, positions it well for future success. However, the plan must navigate key security risks, including regional instability and environmental concerns, to ensure the safety and sustainability of operations.